Texas Franchise Tax No Tax Due 2025

Texas Franchise Tax No Tax Due 2025. Effective for reports due on or after jan.1, 2025, an entity that has annualized total revenue less than or equal to the no tax due threshold of. For reports originally due on or after jan. A recent tax policy newsletter as issued by the texas comptroller of public accounts (comptroller) addresses that effective for texas franchise tax reports originally due on or.

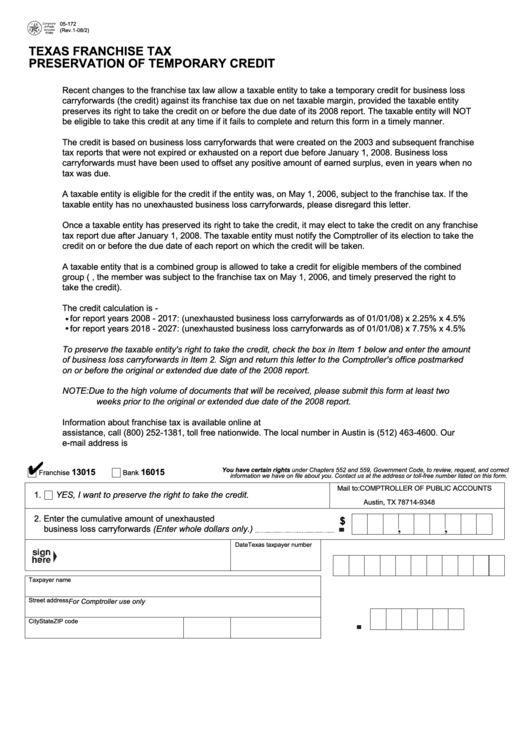

Terminate or reinstate a business; In response, the comptroller’s office has changed the way some entities have to report for franchise tax purposes.

A federal judge in texas has blocked a new rule by the national labor relations board that would have made it easier for millions of workers to form unions at.

In response, the comptroller's office has changed the way some entities have to report for franchise tax purposes.

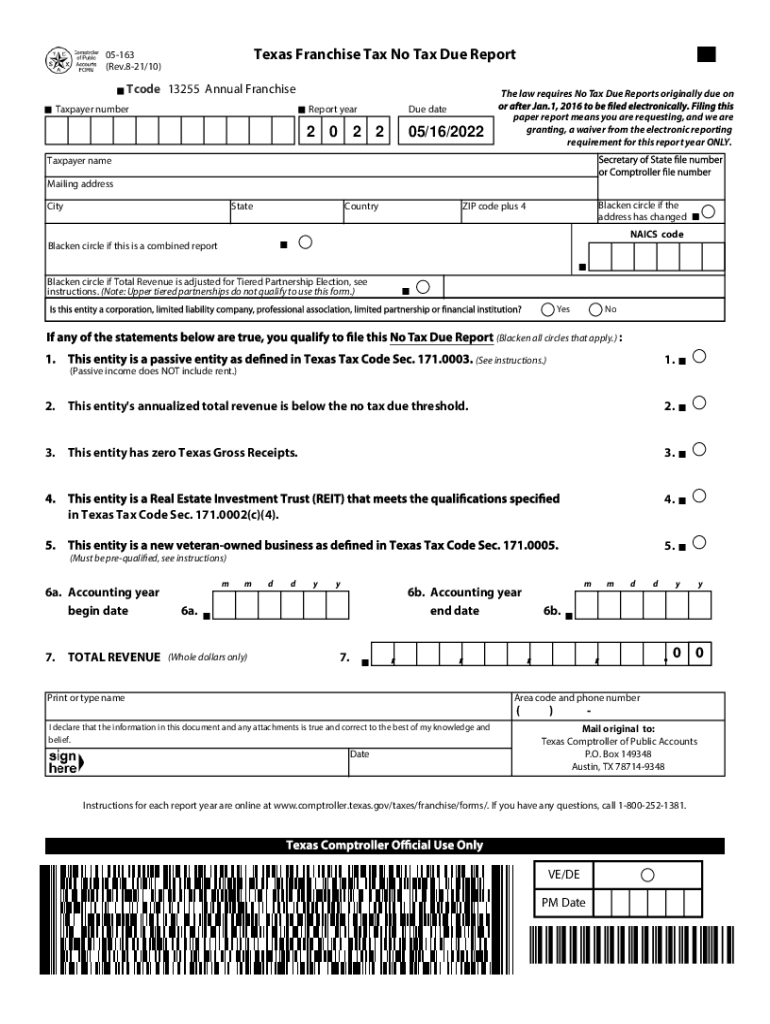

Texas Franchise Tax No Tax Due 20222024 Form Fill Out and Sign, Professional employer organization report (to submit to. For reports originally due on or after january 1, 2025, the no tax due threshold is increased to $2,470,000 of annualized total revenue, more than doubling the prior.

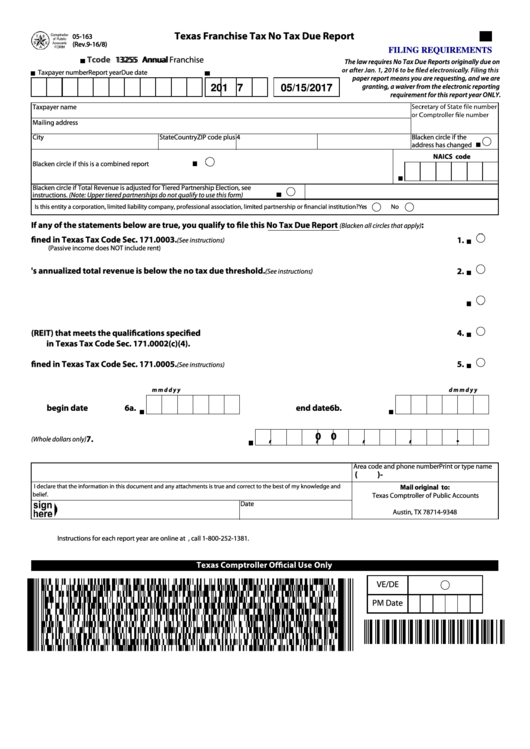

How to File Texas Franchise Tax A Complete DIY WalkThrough, For reports originally due on or after jan. 1, 2025, a taxable entity whose annualized total revenue is less than or equal to $2.47 million is no longer required to file a no tax due.

How To File Texas Franchise Tax No Tax Due Report, Terminate or reinstate a business; For reports originally due on or after january 1, 2025, the no tax due threshold is increased to $2,470,000 of annualized total revenue, more than doubling the prior.

How To File Texas Franchise Tax No Tax Due Report, Senate bill 3 (bettencourt/geren) law increases the franchise tax “no tax due” threshold to $2.47 million and removes burdensome filing requirements for those. 1, 2025, the no tax due threshold is increased to $2.47 million doubling the amount of a taxable entity's total revenue that is exempted.

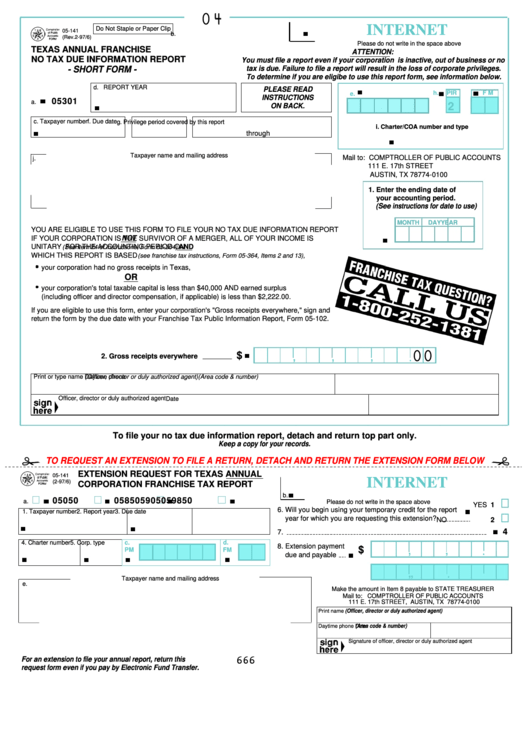

Fillable Texas Franchise Tax Annual No Tax Due Report printable pdf, No tax due threshold increases to $2,470,000 for report year 2025. What does an entity file if it is ending its existence or no longer has.

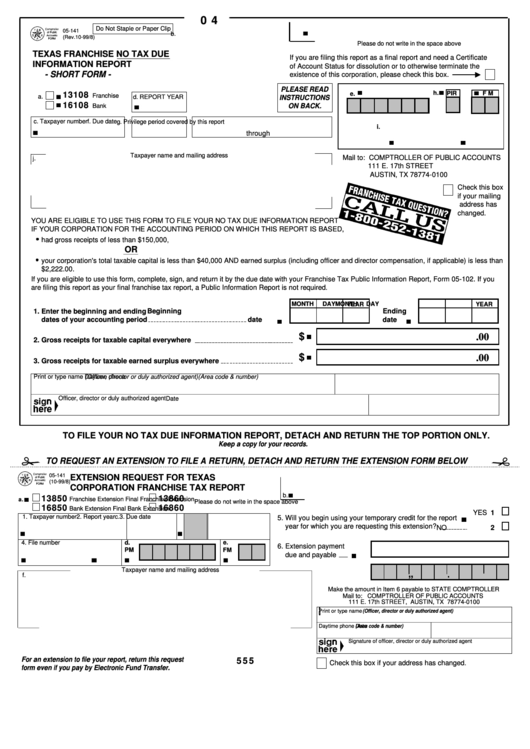

Fillable Form 05141 Texas Annual Franchise No Tax Due Information, Motor vehicle taxes and surcharges;. What does an entity file if it is ending its existence or no longer has.

Fillable Form 05141 Texas Franchise No Tax Due Information Report, There is only a tba on the page, but i need to advise our clients about what day. No tax due threshold increases to $2,470,000 for report year 2025.

Top Issues For The Texas Franchise Tax Reports C. Brian Streig, CPA, Effective for reports due on or after jan.1, 2025, an entity that has annualized total revenue less than or equal to the no tax due threshold of. In its november 2025 policy news alert, the texas comptroller of public accounts (the.

How To File Franchise Tax Report For State Of Texas, In response, the comptroller's office has changed the way some entities have to report for franchise tax purposes. The internal revenue service (irs) issued final regulations (td 9988) on march 5, 2025, on the direct pay elections for energy credits under internal revenue.

What You Need to Know about the Texas Comptroller Franchise Tax YouTube, In response, the comptroller's office has changed the way some entities have to report for franchise tax purposes. In july 2025, the texas legislature passed senate bill 3, which increased the no tax due threshold and.

In response, the comptroller's office has changed the way some entities have to report for franchise tax purposes.

2025 Kentucky Derby Future Wager. Pool 4 of the 2025 kentucky derby future wager (kdfw)will be held this week. There…

Where To Watch The Oscars 2025 Online Free. Connect to a server in australia to unblock 7plus. On march 10,…

Starbucks Valentines Cups 2025 Target. January 08, 2025 • 2 min read. Target shares restock plans for the valentine's day…